The main topic currently gripping the student press is the proposed cuts to education funding, which will cause student fees to rise to up to £9,000 per year.

I should be going mental at how “unfair” this all is, but I’m not. Unpopular as it may sound, I take the view the cuts are “fair”, and will help save the country from defaulting on its loans. And no, this is not because I want to look like a fascist student bully.

Would it be fair for hundreds of thousands of government workers to lose their jobs, just so we can have our degrees subsidised and go on to be better educated than the majority of the country?

As current UK students, all of these cuts seem unfair to us because something is being taken away, so naturally we react negatively towards it. We moan “9K NO WAY”, when in comparison annual tuition in the U.S. is between £15,000 and £22,000. Even with the hikes, we are extremely lucky to have lower tuition fees than American students, with an easy, fair, and structured repayment system. Not forgetting the state-funded health costs we don’t pay at university for all those clumsy and drunken accidents.

As current UK students, all of these cuts seem unfair to us because something is being taken away, so naturally we react negatively towards it. We moan “9K NO WAY”, when in comparison annual tuition in the U.S. is between £15,000 and £22,000. Even with the hikes, we are extremely lucky to have lower tuition fees than American students, with an easy, fair, and structured repayment system. Not forgetting the state-funded health costs we don’t pay at university for all those clumsy and drunken accidents.

I had the pleasure of taking part in a radio debate with a number of people with different political views last week. We discussed a number of key issues, including the UK’s financial deficit.

Peter Apps, the Politics Editor of the Wessex Scene, was among them. He voiced, “The large proportion of it [the deficit] comes from the Government bailing out the banks in the 2008 financial crisis, and that’s a response to reckless free market capitalism”.

This I feel highlights a clear misunderstanding of the situation. Bailing out the banks (£71 billion) has contributed to less that 10% of the debt and only partially to the 07-08’s deficits. Furthermore, the Government is set to make a £30 billion profit from the resale of RBS and Lloyds.

At this current time, the UK needs to control spending to reduce our debt. Even more importantly, we need to be seen spending our money more wisely to encourage investment from other countries (buying our debt).

Even though under the new tuition fees plan, Government spending will be going up in the form of greater tuition and maintenance loans, from a foreign investor’s point of view, this is a more sensible, profitable, and economical way to spend borrowed money. Purely subsidising degrees and increasing their availability does not create economic growth.

Essentially, the cuts are needed because Labour couldn’t control their spending. We have almost £1 Trillion of debt and an annual spending deficit pushing close to £200 Billion. Something has to change.

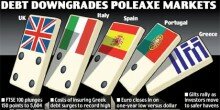

What will be seen now, and will continue to be made evident in the months and years to come is that the cuts are restoring investor confidence in the UK, saving us from a potential financial meltdown like we’ve seen with Greece.

Invest in yourself as much as possible while the opportunity exists; don’t take your subsidised degree for granted and hit the books.

Independence day for the Wessex Scene?

Independence day for the Wessex Scene?

Focus Sports – Uni to go BANKRUPT

Focus Sports – Uni to go BANKRUPT

Rebecca Black to Perform at Twisted – OMFG

Rebecca Black to Perform at Twisted – OMFG

Southampton Vixens – National Champions!!!

Southampton Vixens – National Champions!!!

Varsity 2011 – BE THERE

Varsity 2011 – BE THERE

Interesting article.

By hiking fees you take higher education out of the reach of the working class regardless of their drive or ability and reserve university places for the privileged, approaching the ‘millionaires club’ elitism of the more expensive american universities. A better solution would be to severely limit the number of university places, forcing more competition between students and reducing the number of subsidised degrees without discriminating against poorer families. No-one should feel entitled to a degree, but the opportunity to get one should be available to anyone based on personal merit rather than wealth. In my opinion this competition for degree places would be significantly more motivating than the prospect of crippling debt in the case of failure.

The only way I can get on board with the sharp increase in tuition fees is if it comes with a significant rise in the number of scholarships available for sciences and humanities; these subjects are likely to suffer reduced subscription because they are not seen as ‘worth the investment’ because there is no guarantee of a job on completion. The same goes for subsidies for teaching and nursing, who will want to pay more to enter an important profession with an already uncertain financial future?

Reply

Scientific research has had its budget ring-fenced- there have been no cuts in that area just ‘efficiency savings’- i.e. no guarantee for jobs maybe (like most degrees) , but it’s not as gloomy as first thought for us Bsc lot.

x

Reply

So what your saying is that the government loaning me money, is better than subsidising my degree?

I guess I would work a lot harder and get involved more if I took the view that I was investing my own money in myself. I think that maybe SUSU should promote self investment more.

p.s. risky opinion to publicly take as a student LOL.

Reply

The first half of my other comment is retarded, must have written it too quickly because that’s not what I meant at all. Essentially I support the idea of raising fees so each student takes personal responsibility for funding their own education but the government has to be extremely careful how the changes are bought in. The culture of the middle classes all going to uni will not change overnight and could leave thousands with debt they struggle to repay. If the fees are raised so dramatically then deciding to go to university is an incredibly serious financial decision I don’t think all 17-18 year olds are responsible enough to make, loaning just under £40 000 to someone that young to develop their career seems almost irresponsible.

What I’m trying to say is there has to be better guidance in schools about choosing a degree and planning a career because it’s a life-changing amount of debt for some letters after your name. Yes we need to reduce the deficit but it shouldn’t be done without considering the consequences of putting a generation in personal debt.

Reply

I agree, I believe that by increasing fees to 6-9k it will introduce a market system to the whole thing, the universities will be more accountable for their courses. And a belief shift needs to occur that university is not be all end all.

Sometime I wish I had just started a business and not come here lol.

Reply

Since I’m directly quoted in this article, I suppose I should make a couple of comments.

Your figures may not take into account the full cost of the bail out of the banking sector. Have a look at this http://ukhousebubble.blogspot.com/2009/03/uk-bailout-costs-close-to-100-percent.html

I would also point out the figures showing the point when the UK debt became unmanageable as 2008 (the year of the banking crisis, which as I said was caused by reckless free market capitalism) http://www.statistics.gov.uk/cci/nugget.asp?id=277

About the immediate necessity of such deep government cuts: This graph also shows that the UK debt as percentage of GDP is comparatively moderate, lower than japan, italy, USA, Canada, france and germany http://www.bullfax.com/?q=node-government-debt-percentage-gdp-1990-2009-usa-japan-germ

Ireland, in terrible financial straits as you consistently pointed out on the radio show, yesterday announced cuts which are actually less than those in Britain and will see less public sector workers laid off. Ireland also combined it with tax raises to hit higher earners, something we won’t do in Britain with a Tory government made up of higher earners. These cuts are too much too soon, and aren’t balanced out with any taxes on corporations, banks or richer people. They are being left to carry on as they did pre-recession, while those who work for or are dependant on the public sector are made to pay for it. As I said on air, the cuts are Tory policy, not economic necessity.

A couple of points from this article,

“Would it be fair for hundreds of thousands of government workers to lose their jobs, just so we can have our degrees subsidised and go on to be better educated than the majority of the country?”

500,000 public sector workers could lose their jobs as a result of the cuts in the spending review. The money saved from education cuts isn’t being used to keep them in work, in fact, their jobs going is part of the same policy.

Also, the obvious point that you miss, the government still provide the capital for the Student Loans Company to loan to students, so they won’t see any savings in the short term from these plans. They will increase debt, and therefore reduce graduate spending later in life, potentially making things worse. Again its about policy, Tory governments don’t like to see things funded by taxes where they could be paid for privately, regardless of the inequality that will cause.

Overall this is about policy, not necessity, as I said on air.

Reply

Article –

“Even though under the new tuition fees plan, Government spending will be going up in the form of greater tuition and maintenance loans, from a foreign investor’s point of view, this is a more sensible, profitable, and economical way to spend borrowed money. Purely subsidising degrees and increasing their availability does not create economic growth.”

Pete Apps –

“Also, the obvious point that you miss, the government still provide the capital for the Student Loans Company to loan to students, so they won’t see any savings in the short term from these plans.”

Reply

I suppose I’ll have to acknowledge that was obviously wrong on my part.

But the point remains that since, as you admit, this won’t reduce spending, the issue with the level of debt, which your argument hangs on becomes much less relevant.

Reply

My point is about defaulting on the debt. You are right in mentioning Canada, USA, Japan Italy and Germany…well maybe not Germany. Those countries are also bearing an astronomical risk with their spending. Germany is having positive economic results and so it’s bond re-issue looks like it will be successful. Italy, Spain, Portugal….. really risky. The picture is of dominoes because the UK is not alone in the possibility of a default.

For Ireland, this is the second wave of cuts. The first set were extremely painful for the country’s public services and yet Ireland still managed to default on its debt.

Now that it has taken IMF and EU money it has effectively lost control of its power to decide on its own macroeconomic policy.

So the EU will want it to become more stable but not through competitive economic growth as then it would be hurting the larger more responsible countries’ recovery.

Reply

In the news today?

“The OBR is expected to upgrade its growth forecast for 2010 to 1.7% from the 1.2% predicted in June”

Boom, cuts work – Taxes don’t

Reply